Table of Contents

ToggleFinancial Goals

Financial Goals – A car, a trip, a house of your own, or a decent old age are possible; everything lies in changing your attitude towards money.

Security and economic fulfilment through goods and resources have marked the history of humanity. If something has characterized those who have succeeded in it, it is organization and discipline, but above all, the establishment of financial goals.

How to Set Financial Goals?

Learn to categorize your financial priorities.

Identifying your financial goals helps you determine where you want to go and how to get there, And also. By setting your short, medium, and long-term goals, you will be able to decide on how to organize your savings.

Once you figure out how much you have to save, it’s time to think about how you will do it. Consider the following planning strategies:

Short-term strategies: You should be able to easily access your funds for short-term goals within the following year. Consider keeping the money in a savings or money market account to access these funds when you need them.

Mid-Term Strategies: To stay focused and motivated on your goals for the next 2-5 years, try using budgeting tools to help you keep track of how close you are to reaching your goal, And also. When saving for a specific event, consider contributing to specialized education savings options, like a child’s college education.

Also Read: What are the Latest Trends in Influencer Marketing?

Types of Financial Goals

A financial goal is something that you want to achieve from a correct administration of your resources, for example starting a business, travelling, or having your own home, And also. Before setting one, it is important to consider: Here are some tips to make the best decisions about your money and give better meaning to your effort, hours of work, and an essential part of your life.

Specific, outlining precisely what is wanted, what time frame, and how it will be achieved.

Improvable: It refers to the fact that the amount or the purpose of being fulfilled will be higher and higher.

Tangible: This means that it can be measured to know how much has been achieved.

Achievable, that is, realistic.

Surpassable: The strategy to achieve the goals should not interfere with your obligations.

Easy to agree: If your family or partner affects your goals, you need to discuss them with them.

They should not be too many, at most three, as experts say that it is almost impossible to work successfully on many objectives simultaneously.

Also Read: Internet Marketing Business BizLeads Virtual Summit-2022

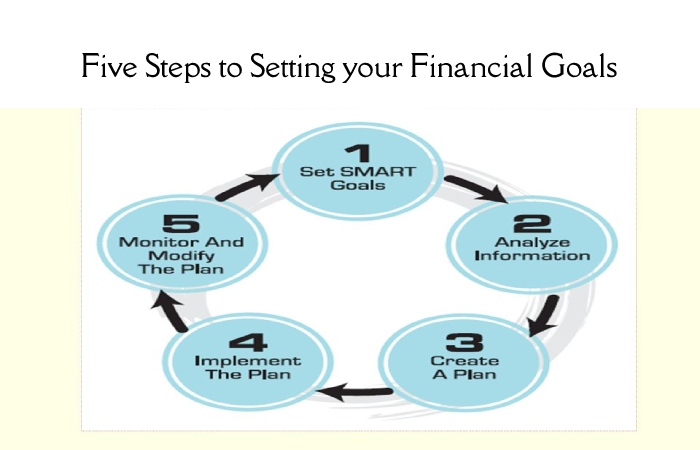

Five Steps to Setting your Financial Goals

Think about your (financial) future Do you want to buy a house with a yard for your dog? Get rid of your student loan debt? Curb your spending habits with credit cards?

Like setting goals for your life or career, setting financial goals helps you prioritize and give you a clear picture of why you’re saving your hard-earned money, And also. If you’ve selected a financial destination for yourself by 2020 (like 95% of millennials1), we will help you make a realistic and achievable plan.

Use this sheet to calculate your financial inventory (PDF) to help you.

1. Think about What you Want your Money to do.

Goals help guide your plan. They don’t have to be permanent. You will modify them during life, but it is necessary to start at some point. Of course, we all want our money to grow, but by how much? How fast? And for what reasons? That varies from person to person.

The critical question is: What kind of life do you want now? And in the future? Let’s look at some examples below.

- 61% want to save more

- 48% want to reduce expenses

- 42% want to pay off credit card debt fully

- 36% want to create an emergency fund

- 23% want to save for retirement

- Primary goals for your life and your money

- Buy a house Or change houses if you already have one.

2. Classify each Goal According to the Term

Use this as a guide to help you complete your financial goal spreadsheet.

- Short-term goals: six months to five years

- Medium-term goals: five to 10 years

- Long-term goals: more than ten years

3. Set a Goal Date for each Financial Goal.

Actuality explicit is helpful, even if you adjust the date over time. If you have a young child who will start college in 2035, you have a target date for your college savings goal, And also. Do you want to take a trip to Europe for your 10th wedding anniversary? You already know what your schedule is. Add target dates to your spreadsheet (PDF).

4. Prioritize each Financial Goal

Having priorities helps you determine where to spend your funds first. Rank each goal on your spreadsheet: essential, necessary, or desired. You have a short-term goal of contributing to your emergency fund, and it’s “essential.” But, another short-term goal is to change cars, which still work fine, And also. This is something “wanted.” If your budget falls a little small any month, you know where to put the money.

5. Know How much you have vs. How Much you Still need to Save

Do you have money saved in a 401(k), 403(b), or IRA? If the answer is yes, enter those numbers into your spreadsheet toward a retirement goal. Please note: Some plans may not currently have savings, And also. Don’t worry. You have to start from somewhere.

If you plan to buy a house two years from now and need an additional $15,000 for a down payment, divide that amount by 24 months, And also. You’ll know you need to save an extra $625 a month to meet that goal.

Conclusion

We dedicate a large part of our lives to designing and trying to meet goals, be it having money, a profitable business, a stable partner, or good friends, And also. However, achieving these goals entails effort and work, And also. It is not necessary to be the smartest, too fast, or too handsome; the most important thing is to be constant, listen and be willing to learn.

Also Read: How to Build an Authentication Flow with React Navigation v5?